Taylor Heinbuch

Aug. 24, 2022, was a muggy, sweltering day at 88 degrees with unbearably high humidity. The sun shone high in the sky, and the air was thick, clinging to anyone brave enough to venture outside. As many Marylanders desperately searched for ways to find relief from the heat, plenty of Americans all over the country found themselves experiencing a different sort of relief: financial relief. Because that was the day that President Joe Biden announced his plan for student loan forgiveness.

The idea of student loan forgiveness is precisely what it sounds like; the cancellation or discharge of a loan acquired to further one’s education, no longer requiring an individual to pay it back. Biden’s student loan forgiveness plan would abolish up to $10,000 of federal debt for most loan recipients and up to $20,000 for students who have also received the Pell Grant. In the weeks following his Aug. 24 announcement, Biden said that it is to be expected that 95 percent of loanees (which is almost 43 million people) would benefit from his student loan forgiveness plan, with 43 percent (which is about 20 million people) having their debt fully canceled.

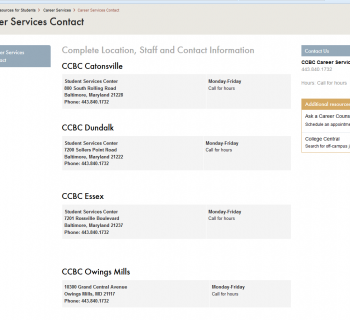

“The benefits of the original student loan forgiveness plan (PSLF) are that it rewards people who have chosen to work in public service. These jobs tend to pay less than private sector jobs but are vitally important to society,” said CCBC Assistant Professor Jeremy Caplan. “I can understand why some may be against it, but in my view, loan forgiveness tends to benefit those who need it.”

And to many U.S. citizens, the student loan forgiveness plan does seem like a blessing; having one less thing to worry about financially is a huge weight lifted off the average person’s shoulders. Although, plenty of other Americans have been quick to voice their displeasure. Many are concerned about how student loan forgiveness will impact the economy and how it primarily caters to lower and middle-income earners.

A chart issued by the White House broke down the allocation of overall dollars forgiven, showing that 87 percent of the money would go to individuals with a yearly income of less than $75,000. However, there is an income cap of $125,000 for participating in the program; any individual earning an annual income of more than $125,000 will not be eligible for student loan forgiveness.

First-year college student Kaelynn Kerns would consider herself in favor of student loan forgiveness though she can also see the potential downfalls.

“I feel as though many will believe that this loan forgiveness is unfair due to either them paying off their loans before this goes into effect or people will believe that the qualifications for it are unfair … due to the increase of inflation, causing sudden household struggles that some haven't faced before. They could (then) think that the income cap should increase to fit their household as well.”

And while many U.S. citizens have been quick to express that sentiment online, college graduate Jeff Nash takes the opposite view.

“As someone with very little student debt remaining, I believe this decision will ultimately open doors of opportunity for individuals and families that have felt restricted by the weight of these loans.”

He explains, “Homeownership, often quoted as the ‘American Dream,’ was unattainable for hundreds of thousands because of student loan debt, despite those with above-average incomes.”

Nevertheless, Republican politicians have threatened to bring a legal challenge against Biden’s student loan forgiveness plan. While no official lawsuit has been filed yet, GOP general attorneys from Arizona, Missouri and Texas are highly considering all their potential options to stop student loan forgiveness from happening. Their most considerable criticism is that the policy would be inequitable to Americans who never attended college and to those who have already paid off their debts or never had to take out a loan in the first place.

However, another college graduate named Kahlan Murray would seem to challenge the Republican argument, saying, “Overall, I don’t feel one way or another since it does not impact me at this time as I paid off my loans.”

That said, to remain on the safe side, experts have suggested that loanees fill out their applications by Nov. 15. The reason for this is that according to the Education Department, it will take about six weeks for cancellation or payment reductions to go into effect. And with the pause on federal student loans expiring on Dec. 31., it is vital that loan recipients try and make sure that their debts are reduced or eliminated by then and before a formal lawsuit is brought. Because even if the courts were to rule against the Biden Administration, there is a good chance loanees will get to keep their student loan forgiveness, so long as their debt was forgiven before the ruling.

Student loan forgiveness is a hot topic of discussion from both sides of the political spectrum, with both liberals and conservatives having valid arguments, whether for or against it. With anything affecting this many people, there will always be mixed reactions. When that happens, it is crucial to listen to both sides and to keep in mind the intention behind a big decision like this and its impact on those it is intended to help.

For more information on student loan forgiveness, visit https://www.ed.gov/subscriptions