Precious Oke

Disclaimer: Articles reflect the views of the author and/or those quoted and do not necessarily represent the views of CCBC or The CCBC Connection.

Since the 46th President of the United States Joe Biden took office, student loan debt has been a major topic his administration has been seeking to address. He openly and actively supported the canceling of $10,000 in federal student loans per individual, due to the Covid crisis.

On Feb. 17, 2021, President Biden rejected an override to his initial student loan forgiveness plan that was pushed by top Democrats, which was that $50,000 in federal student loans should be forgiven instead of $10,000.

Student loan cancellation/forgiveness would be beneficial to students because they get to set out into the world and the labor/workforce, right after their college years knowing they are not in debt.

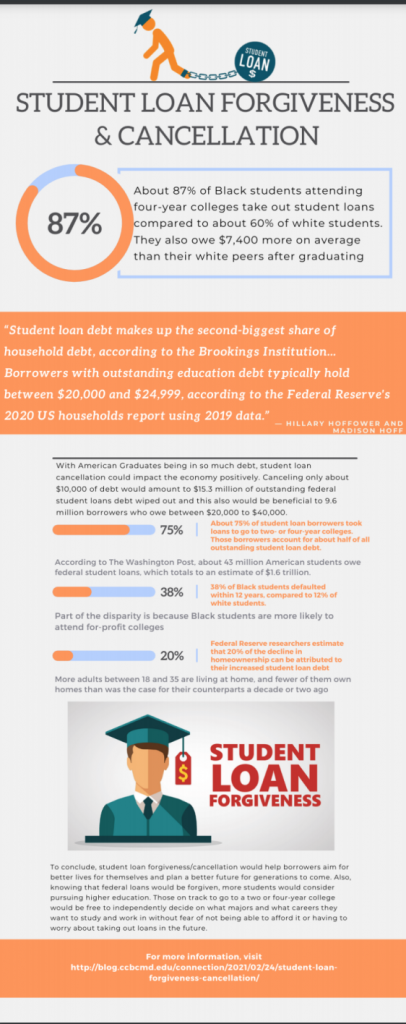

Infographic by MCOM 111 student, Zachary Fisher

Whatever money graduates make from working in their desired field could go into making them more financially stable and eventually they could build a life for themselves and have secured futures that don’t involve repayment of any debt whatsoever.

According to The Washington Post, about 43 million American students owe federal student loans, which totals to an estimate of $1.6 trillion.

An article on Business Insider, titled “The Case for Canceling Student Debt Isn't Political — It's Practical…” by Hillary Hoffower and Madison Hoff, says “Student loan debt makes up the second-biggest share of household debt, according to the Brookings Institution... Borrowers with outstanding education debt typically hold between $20,000 and $24,999, according to the Federal Reserve's 2020 US households report using 2019 data.”

With American Graduates being in so much debt, student loan cancellation could impact the economy positively. Canceling only about $10,000 of debt would amount to $15.3 million of outstanding federal student loans debt wiped out and this also would be beneficial to 9.6 million borrowers who owe between $20,000 to $40,000.

Also, when federal loans are forgiven, students could go back to setting milestones rather than putting them off; they could set realistic goals and make plans for their future. Graduates then get to save up for a car and a house at an early age, and their earnings and savings could also go towards goals of having a family or starting a business. With their loans canceled, they would not have to worry about the monthly payments that go into wiping out their debt, they could put that same money back into circulation, and that eventually also could improve the economy.

According to the Business Insider article, student loan forgiveness would also help narrow the racial wealth gap. There are some statistics that better explain this, saying “black students shoulder a heavier debt burden than their white peers: About 87% of Black students attending four-year colleges take out student loans compared to about 60% of white students. They also owe $7,400 more on average than their white peers after graduating, per Brookings.”

Believe it or not, communities of color and low-income households stand to benefit a lot from debt cancellation because knowing they do not have to worry about debt repayment could be the push they need to pursue a college education. Also, considering the struggles they already undergo and have been through being from a low-income family, the forgiveness would go a long way to bridge the wealth gap.

The article again suggests that from research, in an attempt to boost the economy and bridge the racial wealth gap, $75,000 in loans should be forgiven, so there would be a balance and a substantial increase in household wealth.

To conclude, student loan forgiveness/cancellation would help borrowers aim for better lives for themselves and plan a better future for generations to come. Also, knowing that federal loans would be forgiven, more students would consider pursuing higher education. Those on track to go to a two or four-year college would be free to independently decide on what majors and what careers they want to study and work in without fear of not being able to afford it or having to worry about taking out loans in the future.

I believe you made some very good points in this article and it was a very ineresting read as i would be directly impacted by this. There is a very good chance that forgiving a certain amount of student debt could boost the economy and debt forgiveness also might persuade more low-income students to pursue a degree. While both of these seem great, i do not see how debt relief would work realistically. For one, how would the government differentiate who gets money and who doesnt? For example if a student just finished off paying 60k in loans a year before Biden forgives everyones debt, he would be screwed since he just paid in full while everyone else gets it for free. I also know that the government can really only get money through taxes so chances are, taxes would go up to counteract the 15.3 million they just gave out.

I think this is a great!. To be a college student about to graduate and to know that there is a chance that I can come out of college and be debt free is a awesome feeling. Being able to just focus on work and not debt is a great feeling that a lot of college students like myself would like to experience. So people work just to pay off their school loans. I also feel as though this will be great for the economy as well.